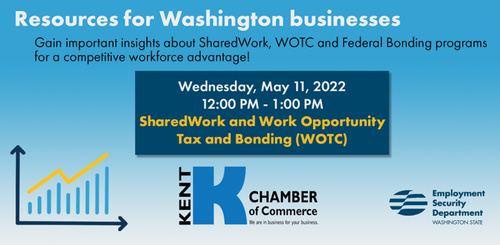

SharedWork & Work Opportunity Tax Credit (WOTC) & Federal Bonding

Date and Time

Wednesday May 11, 2022

12:00 PM - 1:00 PM PDT

Wednesday

May 11

12:00 am - 1:00 pm

Location

Online Webinar

Fees/Admission

Registration is required but FREE to attend

Website

Contact Information

Liza Conboy

Send Email

Description

This webinar features three important business-friendly programs:

SharedWork

Workforce Opportunity Tax Credit

and

Federal bonding

What you’ll learn about the WOTC and Federal bonding:

- Finding an available workforce that provides tax incentives and bonding protection for piece of mind.

- Reduce your Federal income tax liability by $2,400 - $9,600 per employee.

- How to easily and quickly apply using the online filing system.

- Submit all applications within 28 days of the employee's start date and help your business and workers thrive.

- Answers to the most common WOTC and Bonding - employer questions.

What you’ll learn about the SharedWork program:

- Best kept secret for a business to retain its workforce.

- Business eligibility and program benefits.

- Protect the business using the simple steps to enroll in SharedWork program.

- How to scale your workforce when needed and maintain trust, morale and loyalty.

- Impact to experience rates, true or false?